White Spirits Industry Report: Uncovering Key Insights and Market Dynamics

Global white spirits industry data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research.

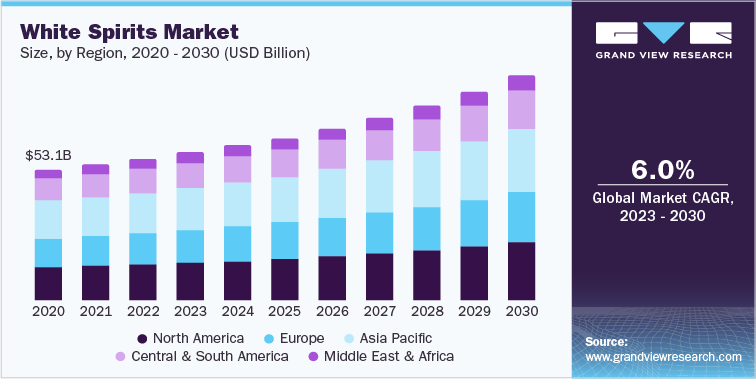

Rapid urbanization, growing population, and rising per capita income of consumers are the key factors driving the market’s growth in the Asia Pacific region. North America and Europe emerged as the major regional markets due to the shift in consumer preferences from beer and ciders to spirits. High consumption of alcohol in countries is expected to boost market growth in the Middle East and Africa.

Access the Global White Spirits Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies.

Vodka Market Report Highlights

The global vodka market size was estimated to reach USD 35.94 billion in 2022 and is expected to expand at a CAGR of 6.2% over the forecast period. Millennials have accounted for a significant percentage of alcohol drinkers in the recent past and this trend is anticipated to continue over the forecast period. Millennials have accounted for a significant percentage of alcohol drinkers in the recent past and this trend is anticipated to continue over the forecast period. The generation exhibits significant purchasing power and represents a major demographic for the alcoholic beverages market as they form a major percentage of consumers frequently visiting restaurants and pubs. As a result, they appear to be the most powerful buyers of various food and drink items, including vodka.

Vodka-based Ready to Drink (RTD) beverages such as pre-mixed cocktails, spirits, and hard seltzers are witnessing a huge increase in new product development, which is expected to drive the market. For example, in March 2022, under the Svedka brand, Constellation Brands launched a canned vodka line. The Tea Spritz line is described as a spirit-based hard seltzer that combines real tea, sparkling water, and natural tropical fruit flavors and is available in three flavors: Orange Mango, Pineapple Guava (both of which include turmeric), and Raspberry Kiwi.

Unlike beer and wine, vodka consumption at restaurants and bars has been growing. The growth is expected to continue outpacing on-premise consumption. With consumers' return to bars following the COVID-19 disruptions, vodka's on-premise consumption has been fueled, and this trend is anticipated to continue. According to IWSR Drinks Market Analysis in 2019, total vodka on-premise sales increased by 5.9% in the U.S. Grey Goose, for example, saw a 181% increase in on-premises sales in 2021, presenting lucrative opportunities for premium vodka manufacturers.

The flavored segment is anticipated to witness the fastest growth rate during the forecast period owing to the growing demand for high-end flavored vodka, especially among the millennial population. key companies are trying to offer a variety of vodka products and pioneer the ‘ready-to-shake’ drinks category. The newly launched product line includes the ‘Whisky Sour’ with DEWAR’S Blended Scotch whisky, ‘Rum Daiquirí’ made with BACARDÍ rum, and the ‘Espresso Martini Cocktail’ and ‘Passion Fruit Martini Cocktail’ made with 42BELOW vodka. With such initiatives

The off-trade segment is expected to register significant growth during the forecast period owing to the discounts and promotional offers provided by the retail outlets. The ease of accessing different varieties of alcohol at the outlets is expected to notable growth during the forecast period.

Asia Pacific is expected to register a significant CAGR of 6.1% during the forecast period. Asia Pacific is one of the leading markets for vodka owing to increased spending from people on better quality beverages in the region. In China, there has been a well-documented shift to buying alcohol online since the start of the pandemic. According to the study published by IWSR, the data shows that from 2019-2020, the value of China’s alcohol e-commerce sector grew by approximately 20%. The increased penetration of online sales of alcohol in China is driving the growth of the vodka market.

Order your copy of Free Sample of “White Spirits Industry Data Book - Vodka, Rum and Gin Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Rum Market Report Highlights

The global rum market size was estimated to reach USD 7.94 billion in 2022, registering a CAGR of 5.3% over the forecast period, according to a new report by Grand View Research, Inc. Rum is one of the most consumed beverages in all spirits, and consumers are highly inclined towards flavored and premium alcoholic beverages. Factors such as the growing urban population coupled with rising per capita income, consumers’ willingness to pay for premium brands, and younger generations increased footprints in places like nightclubs, pubs, and bars are expected to propel the market growth.

The high demand for flavored and spiced rums observed in recent years is driving the growth of the overall market. Rum is also extensively used for shakers, drink mixes, and cocktails thereby driving its demand among consumers. For instance, as per Wine and Spirit Trade Association in 2020, rum was declared the “drink of lockdown” owing to the availability of flavor-infused varieties. The change in consumer tastes and the growing demand for small-batch, handcrafted rum with darker/bolder flavor profiles are contributing to the growth of the market. For instance, Ron Zacapa 23 is made with brown sugar and hints of chocolate and caramel. This expression blends six to 23-year-old rum using the solera process, which combines younger and older liquids in oak casks. Such flavors have a higher preference among regular rum drinkers.

Technology-driven trends in the aging process of the product have changed consumer preferences to a considerable extent. Consumers largely opt for aged rum with darker and bolder flavors. The trends in product sales are largely driven by brand awareness, shopping frequency, and expenditure capability of different buyers. The purchasing habits of younger consumers are often influenced by the price point and brand position. A key observation in the buying behavior of millennials is the preference for brands available on online platforms, after comparing price and style.

The market growth is anticipated to be driven by the positive health associations linked to moderate consumption. When consumed in limited amounts, rum is believed to offer various health benefits, including promoting a healthy heart, aiding in the fight against common colds, and potentially benefiting individuals with diabetes by helping to lower blood sugar levels.

Gin Market Report Highlights

The global gin market size was estimated to reach USD 13.49 billion in 2022, registering a CAGR of 5.9% over the forecast period, according to a new report by Grand View Research, Inc. The growth of the gin market can be attributed to several key factors that have contributed to the increasing popularity of gin. One such factor is the rising demand for gin cocktails, which have become a favored choice among consumers. Additionally, there is a noticeable increase in the preference for premium spirits, driving the expansion of the gin market. This trend of "premiumization" is particularly appealing to younger consumers who possess more refined palates and actively seek out unique and high-quality alcoholic beverages.

Moreover, consumers are becoming more conscious of their health and are increasingly aware of the potential benefits associated with consuming gin. This growing awareness has played a role in boosting market growth as gin is perceived to have certain health advantages.

To cater to evolving consumer preferences, the alcoholic beverage industry has embraced the use of natural ingredients. By incorporating natural flavors, these beverages are enhanced both in terms of functionality and overall appeal. This emphasis on natural flavors has gained significant popularity within the industry, as it preserves the authentic taste and rustic charm of gin. Consequently, gin has become a favored choice for creating high-quality drinks, prominently featured on on-trade counters.

Go through the table of content of White Spirits Industry Data Book to get a better understanding of the Coverage & Scope of the study.

Competitive Landscape

Key players operating in the White Spirits Industry are –

• Diageo plc

• Rémy Cointreau

• Bacardi Limited

• Pernod Ricard

• Beam Suntory, Inc.

• Radico Khaitan

• Stock Spirits Group

• Hite Jinro Co Ltd

• Constellation Brands Inc

• MIGUEL TORRES SA

• Brown‑Forman

• Proximo Spirits, Inc.

• Distell Limited

• Suntory Beverage and & Food Limited

• Alberta Distillers, LTD

• William Grant & Sons

• San Miguel Food and Beverage, Inc.

• DESI DARU LTD

• AMBER BEVERAGE GROUP

• JACOB RIEGER & CO.

Comments

Post a Comment