Flavors & Fragrances Industry To Rise Due To Increasing Disposable Income In Developing Economies

Flavors & fragrances industry data book covers natural flavors & fragrances and aroma chemicals market.

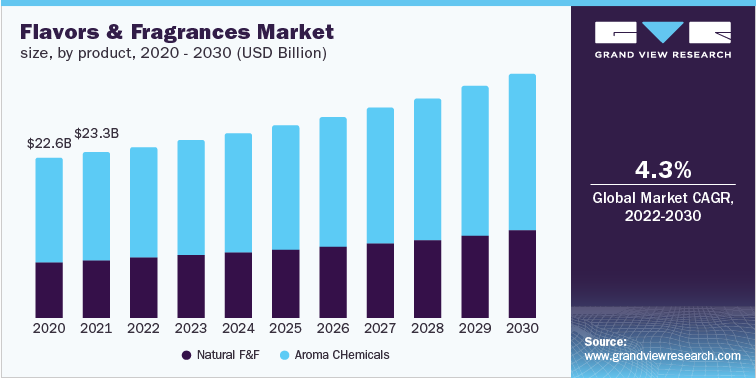

The economic value generated by the flavors & fragrances industry was estimated at approximately USD 23.35 billion in 2021, is anticipated to expand at a compound annual growth rate (CAGR) of 4.3% from 2022 to 2030.

Grand View Research’s flavors & fragrances industry databook is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Natural Flavors & Fragrances Market Insights

The global natural flavors and fragrances market was valued at USD 8,510.4 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. The growth is driven by the growing demand for the product in convenience food and packaged food items. The industry growth was hampered amid the COVID-19 pandemic, as there were several restrictions on the import and export of chemicals coupled with quarantine and lockdown measures acting as some of the key barriers faced by several product manufacturers. The pandemic directly impacted people’s choices, lifestyles, preferences, health, and well-being.

Oleoresin products include paprika, black pepper, capsicum, turmeric, ginger, garlic, onion and others. The ability of oleoresins to enhance the taste, color, flavor, and shelf life of the final product is expected to fuel the demand. Each ingredient is utilized based on its properties. For instance, the rising demand for colorants coupled with natural spices has propelled the demand for paprika across the world. Paprika oleoresins are extensively used in food industry as natural flavoring, also find its usage in meat products, cheese, popcorn oil, and cheese food coatings.

Europe dominated the global market with the highest revenue share of 28.04% in 2021. This is attributed to the increased popularity of ethnic cuisines and growing awareness regarding less sodium intake. Countries, such as the U.K., Germany, Spain, and France, are characterized by the presence of a well-developed food industry, which is the most significant end-user for the product. The presence of advanced end-use industries coupled with growing awareness regarding the benefits of essential oils is estimated to provide significant growth potential for the Europe regional market. In addition, the German economy is considered diverse and is the largest economy in Europe.

Order your copy of the Free Sample of “Flavors & Fragrances Industry Data Book - Natural Flavors & Fragrances and Aroma Chemicals Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Aroma Chemicals Market insights

The global aroma chemicals market size was valued at USD 15,639.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. The growth is attributed to increased consumption of flavors & fragrance products in the cosmetics & toiletries, soaps & detergents, and food & beverages industries. Aroma chemicals are witnessing an increase in demand owing to the growing application scope in key end-use industries such as dairy, cosmetics & toiletries, soaps & detergents, fine fragrances, convenience foods, bakery foods, and confectionery. Moreover, increasing demand for low calories drinks and growth in the beverages market, are the major factors driving the growth of the industry.

Flavors being a prominent factor in taste in edible products, aroma chemicals are utilized to augment the taste in beverages and processed food. Increasing demand for health and wellness foods, regulation, and the ban on the use of some synthetic flavors are triggering the growth of natural aroma chemicals. The suitability of natural flavors in wider applications, additional health benefits of certain natural flavors, and advanced technological innovation are the key factors driving the market growth.

Aldehydes are formed owing to partial oxidation of primary alcohols to form carboxylic acids when they are furthermore oxidized, aldehydes differ in term of structure bond angles and smell. Aldehydes aroma relies on the structure and the size of the bond. The most common type of aldehydes used in the fragrance and the flavor industry is fatty aldehydes which tend to have a very pleasant odor with a fruity or floral scent which is detected even in very low conditions.

Asia Pacific dominated with a revenue share of 30.80% in 2021. This is attributed to the increased demand for fragrances and flavors in developing countries such as India. Asian flavors and fragrances have gained high popularity in major regions such as North America and Europe. Pakistan, China, Taiwan, the Philippines, and South Korea have emerged as prominent fragrance markets, whereas China, India, Australia, and Southeast Asian countries including Indonesia, Vietnam, and Malaysia are among the prominent food flavor markets in the region.

In terms of revenue, the U.S. holds a significant share in the North America aroma chemicals industry, which is expected to grow over the forecast period owing to the rising demand for aroma chemicals from the cosmetics & personal care industry. Low-fat food & beverage products require additional flavors to augment the taste of the final product. The high prevalence of obesity in the U.S. and growing demand for low-calorie food are likely to boost the demand for a variety of flavors, which is anticipated to drive the demand for aroma chemicals.

Go through the table of content of Flavors & Fragrances Industry Data Book to get a better understanding of the Coverage & Scope of the study.

Flavors & Fragrances Industry Data Book Competitive Landscape

Though the COVID 19 pandemic led multiple chemical manufacturers to witness a decline in sale of their products, The flavors & fragrance sector was less affected by the same. The major players in the business, namely, Givaudan and Symrise, witnessed an increase in sales while the International Flavors & Fragrances saw a slight decline in the revenue.

Key players operating in the flavors & fragrances industry are –

• Givaudan

• Symrise AG

• International Flavors & Fragrances Inc. (IFF)

• Biolandes SAS

• Young Living Essential Oils

• dōTERRA International

• Falcon Essential Oils

• Flavex Naturextrakte GmbH

• Universal Oleoresins

• Synthite Industries Limited

• Ungerer & Company

• Akay Flavours & Aromatics Pvt. Ltd.

• Indo World

• BASF SE

• Vigon International, Inc.

• Firmenich SA

• Elevance Renewable Sciences, Inc.

• Ozone Naturals

• Alpha Aromatics

• Manohar Botanical Extracts Pvt. Ltd.

• Takasago International Corporation

• Mane SA

• Sensient Technologies Corporation

Comments

Post a Comment